ESG Commitment

Understand what ESG is and learn about the practices adopted by companies in the social, environmental and governance areas.

ESG Commitment: Importance, Practices, and Benefits

ESG practices and goals are gaining increasing strength and are being adopted by companies that are concerned with building a more sustainable future for the next generations. This trend reflects a significant change in the way in which these institutions perceive their own role in society and allows them to assess their impact on the environment

.What is ESG?

ESG is the English term for Environmental, Social and Governance, which means Environmental, Social and Governance (ASG), in Portuguese translation. The acronym has come to be used more frequently in recent years, including in Brazil, and refers to the practices adopted by companies to assess how they are performing in relation to sustainability and social responsibility actions

.What are the three pillars of ESG?

The letters of the acronym ESG represent three basic principles that companies must consider, namely:

Environmental/Environmental

Practices that contribute to the environment, working on topics such as biodiversity, deforestation, global warming, air and water pollution, among others.

Social

Actions aimed at social responsibility, such as human rights, labor laws, relationships with the local community, data protection, etc.

Governance/Governance

Processes related to strategies and guidelines of business administrations, such as anti-corruption practices, existence of reporting channels about cases of harassment, discrimination and corruption, data transparency, etc.

How and when did ESG appear?

ESG was first mentioned in the report “Who Cares Wins”, prepared by the United Nations (UN) Global Compact, in partnership with the World Bank, in 2004. The document was prepared after a provocation by the then UN Secretary General, Kofi Annan, to 50 presidents of major institutions, to implement good environmental, social and corporate governance practices internally.

Práticas que contribuem com o meio ambiente, trabalhando temas como biodiversidade, desmatamento, aquecimento global, poluição do ar e da água, entre outros.

Ações voltadas à responsabilidade social, como direitos humanos, leis trabalhistas, relacionamento com a comunidade local, proteção de dados etc.

Processos ligados a estratégias e orientações de administrações de empresas, como práticas anticorrupção, canais de denúncias sobre casos de assédio, discriminação, transparência de dados etc.

Como e quando surgiu o ESG?

O ESG foi citado pela primeira vez no relatório "Who Cares Wins", feito pelo Pacto Global da Organização das Nações Unidas (ONU), em parceria com o Banco Mundial, em 2004. O documento foi elaborado após uma provocação do então secretário-geral da ONU, Kofi Annan, a 50 presidentes de grandes instituições, para que implantassem internamente boas práticas ambientais, sociais e de governança corporativa.

ESG and the 17 UN Sustainable Development Goals

The factors related to the term ESG are directly linked to the 17 UN Sustainable Development Goals (SDGs), which represent the main development challenges faced worldwide and which need to be addressed by 2030.

Organizations that adopt ESG practices are more likely to contribute to achieving the SDGs, so it is very important for companies to be committed to these goals. For example, a company that has initiatives to reduce greenhouse gas (GHG) emissions is directly contributing to Goal 13, which aims to combat climate change

ESG in business: what companies are doing to be more sustainable

Companies are increasingly adopting ESG and are committed to promoting environmental responsibility, social initiatives, and responsible corporate governance. According to the 'ESG Market Navigator' survey, conducted by Bloomberg Intelligence, in 2023, 84% of respondents stated that ESG factors help to have a more robust corporate strategy, in addition to being beneficial to the company's reputation and facilitating access to capital.There are several ESG practices that companies can adhere to. Among the most common are recycling, the use of clean energy (photovoltaic and wind), support for diversity and inclusion for employees, charitable campaigns in the communities where they operate, financial and accounting transparency through public reports, and the implementation of anti-corruption practices.

What are the advantages of ESG practices in companies?

There are many advantages for companies that invest in ESG practices. It's not just about an ethical or image issue, but about maintaining positive aspects of competitiveness and survival. The benefits are:- Cost reduction;

- Increase in revenues;

- Access to capital;

- Risk management;

- Reputation improvement;

- Talent development.

How to measure if companies are doing it right?

B3 Business Sustainability Index (ISE B3)

To analyze the performance of institutions in relation to their commitment to ESG factors, the Business Sustainability Index of the São Paulo Stock Exchange, B3 (ISE B3), was created in 2005. It is the fourth sustainability indicator in the world and the first in Latin America. To receive the seal, companies must clearly publish their commitments and criteria, just as Neoenergia announced its ESG targets approved by the Board of Directors up to 2030.One of the grounds used by ISE B3 is the rating awarded to companies by CDP, a non-profit organization. The scoring process considers the structure of the TCFD (Task Force on Climate-Related Financial Disclosures) for the climate notebook. The result shows how prepared institutions are to manage climate and water risks and opportunities, evaluating the company's levels of disclosure, awareness, governance, and leadership.

In the regulatory field, companies listed on the Securities and Exchange Commission (CVM) must, within the scope of CVM Resolution 80/22, report material environmental and social data. The measure provides for possible new information required from issuers registered in Category A regarding the disclosure of certain legal and arbitral claims based on corporate or securities market legislation, or on regulations issued by the Commission.

ESG Reports

Companies can also report on ESG practices adopted internally on a voluntary basis. The Integrated Annual Report, for example, aims to improve accountability and responsibility for managing aspects involved in a company's operations. Even though it is not mandatory, the institutions supervised by the CVM that decide to make this disclosure must comply with the rules of CVM Resolution 14/2020, which refer to Technical Guidance CPC (Accounting Pronouncements Committee) No. 09/2020.In this type of report, companies adopt ESG models standardized by organizations, such as the “Value Reporting Foundation (VRF)”, which establishes sustainability reporting methodologies that facilitate the identification, measurement, and communication of material aspects relevant to investors. It is based on financial materiality criteria, which may affect the company's profits. Another is the “Global Reporting Initiative (GRI)”, which focuses on contributions to sustainable development, with materiality in addition to financial aspects, encompassing impacts on different corporate audiences (employees, consumers, society in general, communities, among others).

What is Neoenergia's commitment to ESG practices?

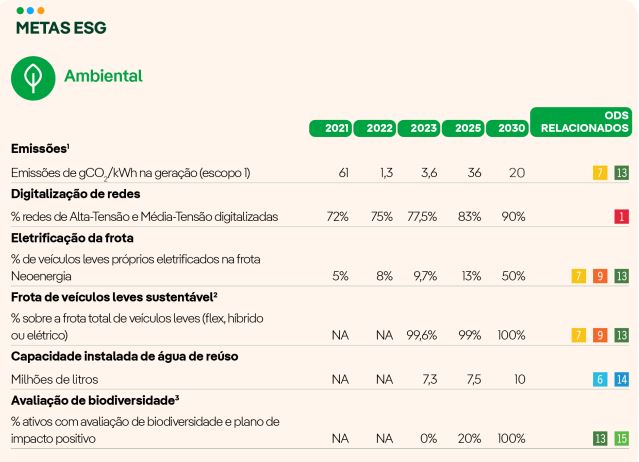

Neoenergia established ESG targets until 2030, reinforcing its commitment to creating sustainable value and operational transparency. Approved by the company's Board of Directors, the most important commitments are: reducing the intensity of carbon emissions in its generation; increasing diversity in the company in terms of gender and race in leadership positions; increasing the number of women in electrician positions; and having large suppliers classified as sustainable.The company's results in terms of ESG aspects are consolidated in annual publications, such as the Annual Report - ESG+F Statement, the Integrated Report and the Tax Transparency Report. ESG goals have been part of the business strategy since the beginning of Neoenergia's activities and are aligned with its commitments to the Principles of the Global Compact and the Sustainable Development Goals (SDGs), initiatives of the United Nations (UN).

Check out Neoenergia's ESG commitments